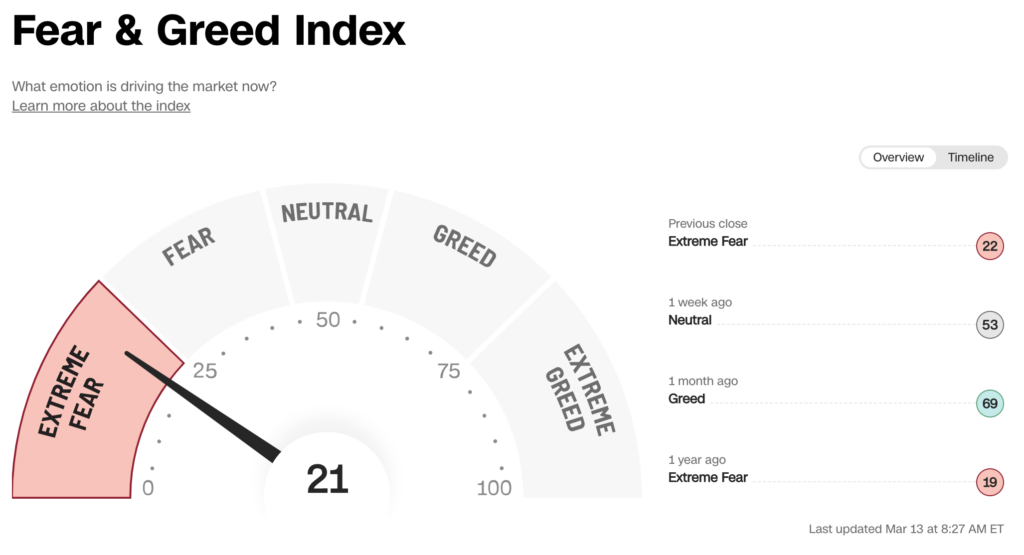

What feeling is driving the stock market right now, fear or greed? The Fear & Greed Index indicates extreme fear in the US stock market.

CNN’s Fear & Greed Index is a way to measure movements in the stock market and whether stocks are correctly priced, according to CNN.

Measuring market sentiment

The theory is based on the logic that excessive fear tends to drive down stock prices and excessive greed tends to do the opposite.

When the US S&P 500 index is above its average for the previous 125 trading days, it is seen as positive momentum, and when it is below, it indicates that investors are nervous.

On the market, the returns for a small number of large stocks can skew the market’s performance, which is why it is important to know how many stocks are doing well compared to how many are doing poorly.

Decreased trading volume

On the New York Stock Exchange, thousands of stocks are actively bought and sold every day. When most stocks are doing well, it is a sign of a bull market. When the number of rising stocks is low compared to the number of falling stocks, it is a sign of a bear market. The Fear & Greed Index sees decreasing trading volume as a signal of fear.

Volatility index

The most well-known measure of market sentiment is the CBOE Volatility Index, VIX, which measures price changes, or volatility, in S&P 500 index options over the next 30 days.

When stocks fall, VIX rises and when the broader market rises, VIX often falls, but the key is to look at the indexes over time.

In bull markets, VIX tends to be lower and in bear markets, it tends to be higher. The Fear & Greed Index sees increased market volatility as a sign of fear.

Fear is currently driving the market

Bonds are less risky than stocks, and the Fear & Greed Index sees increased demand for bonds as a signal of fear.

The Fear & Greed Index is currently at Extreme Fear, heading towards Fear. It was at Neutral a week ago and at Greed a month ago.